This transaction would reduce cash by $9,500 and accounts payable by $10,000. The difference of $500 in the cash discount would be added to the owner’s equity. As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets.

What Is the Accounting Equation?

Your assets are worth $10,000 total, while your debt is $5,000 and equity is $5,000. The inventory (asset) of the business will increase by the $2,500 cost of the inventory and a trade payable (liability) will be recorded to represent the amount now owed to the supplier. To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation.

Why You Can Trust Finance Strategists

For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. We could also use the expanded accounting equation to see the effect of reinvested earnings ($419,155), other comprehensive income ($18,370), and treasury stock ($225,674). We could also look to XOM’s income statement to identify the amount of revenues and dividends the company earned and paid out. The balance sheet equation is the foundation of the dual entry system of accounting. It shows that for every debit, It shows that there is an equal and opposite credit for every debit, and the sum of all the assets is always equal to the total of all its liabilities and equity.

Income and retained earnings

Required Explain how each of the above transactions impact the accounting equation and illustrate the cumulative effect that they have. Metro Courier, Inc., was organized as a corporation on January 1, the company issued shares (10,000 shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son. Explore our online finance and accounting courses, which can teach you the key financial concepts you need to understand business performance and potential. To get a jumpstart on building your financial literacy, download our free Financial Terms Cheat Sheet. The information found in a company’s balance sheet is among some of the most important for a business leader, regulator, or potential investor to understand.

Impact of transactions on accounting equation

If you were to take a clipboard and record everything you found in a company, you would end up with a list that looks remarkably like the left side of the Balance Sheet. The accounting equation sets the foundation of “double-entry” accounting, since it shows a company’s asset purchases and how they were financed (i.e. the off-setting entries). Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. Each category consists of several smaller accounts that break down the specifics of a company’s finances.

- Updates to your application and enrollment status will be shown on your account page.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- This financial statement is used both internally and externally to determine the so-called “book value” of the company, or its overall worth.

- In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity.

Metro issued a check to Office Lux for $300 previously purchased supplies on account. Liabilities may also include an obligation to provide goods or services in the future. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

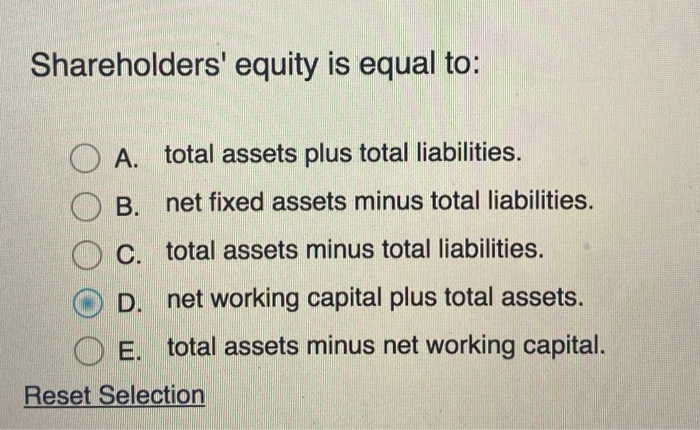

The total dollar amounts of two sides of accounting equation are always equal because they represent two different views of the same thing. The accounting equation asserts that the value of all assets in a business is always equal to the sum of its liabilities and the owner’s equity. For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K). The fundamental accounting equation, as mentioned earlier, states that total assets are equal to the sum of the total liabilities and total shareholders equity.

For every business, the sum of the rights to the properties is equal to the sum of properties owned. Our popular accounting course is designed for those with no accounting background or those seeking a refresher. After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program. Please review the Program Policies page for more details on refunds and deferrals. Updates to your application and enrollment status will be shown on your account page. We confirm enrollment eligibility within one week of your application for CORe and three weeks for CLIMB.

For instance, inventory is very liquid — the company can quickly sell it for money. Real estate, though, is less liquid — selling land or buildings for cash is time-consuming and can be difficult, depending on the market. Accountants and members of a company’s financial team are the primary users of the accounting equation.

Since they own the entire company, this amount is intuitively based on the accounting equation – whatever is left over of the Assets after the liabilities have been accounted for must be owned by the owners, by equity. These are listed on the bottom, because the owners are paid back second, only after all liabilities have been paid. If a company’s assets were is capital debit or credit hypothetically liquidated (i.e. the difference between assets and liabilities), the remaining value is the shareholders’ equity account. Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks. For this reason, a balance alone may not paint the full picture of a company’s financial health.