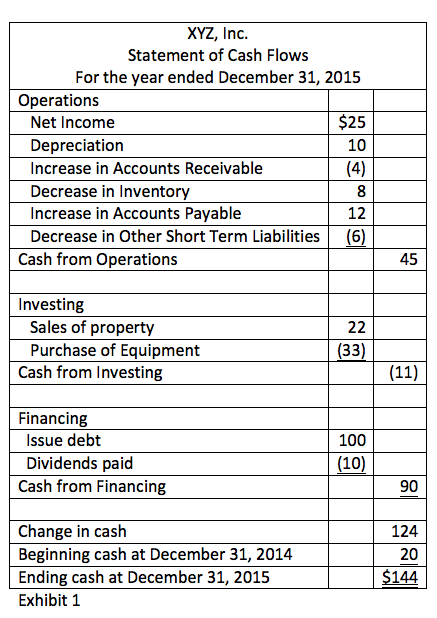

Financing cash flows are calculated by adding up the changes in all the long-term liability and equity accounts. Investing cash flows are calculated by adding up the changes in long-term asset accounts. The cash flow statement is useful when analyzing changes in cash flow from one period to the next as it gives investors an idea of how the company is performing.

How the cash flow statement works with the income statement and the balance sheet

Consolidated direct operating expenses increased $29.7 million, or 7.8%, during the three months ended September 30, 2024 compared to the same period of 2023. The increase was primarily driven by higher variable content costs, including higher third-party digital costs and podcast profit sharing expenses related to the increase in digital revenues. Amount of currency on hand as well as demand deposits with banks or financial institutions. Includes other kinds of accounts that have the general characteristics of demand deposits. Also includes short-term, highly liquid investments that are both readily convertible to known amounts of cash and so near their maturity that they present insignificant risk of changes in value because of changes in interest rates. Excludes cash and cash equivalents within disposal group and discontinued operation.

Investing Cash Flow

Amount of cash outflow to satisfy grantee’s tax withholding obligation for award under share-based payment arrangement. Amount of increase (decrease) in operating assets after deduction of operating liabilities classified as other. Are you interested in gaining a toolkit for making smarter financial decisions and the confidence to clearly communicate them to key stakeholders? Explore Financial Accounting—one of three courses comprising our Credential of Readiness (CORe) program—to discover how you can unlock critical insights into your organization’s performance and potential.

Please Sign in to set this content as a favorite.

It is a crucial statement, as it shows the sources of and uses of cash for the firm during the accounting period. Remember, under accrual accounting, transactions are recorded when they occur, not necessarily when cash moves. Thus, the income statement does not provide all the insights necessary to understand a firm’s cash flows. To fully understand the firm’s flow of cash, the statement of cash flows is needed.

Cash Flow From Investing Activities (CFI)

Using the direct method, you keep a record of cash as it enters and leaves your business, then use that information at the end of the month to prepare a statement of cash flow. When you have a positive number at the bottom of your statement, you’ve got positive cash flow for the month. Keep in mind, positive cash flow isn’t always a good thing in the long term.

- Poor cash flow is sometimes the result of a company’s decision to expand its business at a certain point in time, which would be a good thing for the future.

- If you’re a business owner or entrepreneur, it can help you understand business performance and adjust key initiatives or strategies.

- Cash flows related to investing activities provide insights into the company’s strategic direction and capital allocation.

- For small businesses, Cash Flow from Investing Activities usually won’t make up the majority of cash flow for your company.

- Along with income statements and balance sheets, cash flow statements provide crucial financial data that informs organizational decision-making.

This approach lists all the transactions that resulted in cash paid or received during the reporting period. The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. This value can be found on the income statement of the same accounting period. The following section will show how do i find my employers ean you how to prepare the statement of cash flows (direct method for operating activities section) on page 270 from the financial statements on page 255. The following is a sample statement of cash flows that has been prepared based on the financial statements presented on page 255. The operating activities section uses the direct method in the operating activities section.

This cash flow statement shows Company A started the year with approximately $10.75 billion in cash and equivalents. Your business can be profitable without being cash flow-positive, and you can have positive cash flow without actually making a profit. Whenever you review any financial statement, you should consider it from a business perspective. Financial documents are designed to provide insight into the financial health and status of an organization.

This section records the cash flow between the company, its shareholders, investors, and creditors. Analysts look in this section to see if there are any changes in capital expenditures (CapEx). Investors and analysts should use good judgment when evaluating changes to working capital, as some companies may try to boost their cash flow before reporting periods. The first method used to calculate the operation section is called the direct method, which is based on the transactional information that impacted cash during the period.

If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction. Updates to your application and enrollment status will be shown on your account page. We confirm enrollment eligibility within one week of your application for CORe and three weeks for CLIMB.